I wasn’t always the responsible young lady (ha!) that I am today. I was pretty good about paying my minimum on my credit cards in college, but my balances were damn near the top of my limit. I always had a job–that’s one thing I’ve always been really good about. i’d never leave even a part-time job without having something else lined up. When my seasonal retail job didn’t get converted into a non-seasonal one in the winter of my freshman year of college I think I had a month or so when I was looking for a job to replace it. I’ve never gone to the gym so much in my life! So much free time when you don’t have an employer to visit!

I digress. Once I graduated college I got even more irresponsible. It wasn’t just that I was at my credit limit. I got a “real” job in October after graduation, and bought my new/used car in November. My payments were over $400 a month, and if a given month was tough (because I spent too much), credit card payments were the ones taking the hit. I’m sure Capital One wasn’t terribly upset. I’m quite sure they were happy to charge me late fees and more interest! I had one debt that got sold to a collector because I had the mindset of “if I ignore this, surely it will go away!” I continued with this irresponsibility for a while until my March 2007 bonus. Don’t get me wrong, I spent a LOT of this irresponsibly (how can you give a 24 year old a bonus on or about St. Patrick’s Day? That’s just mean), but I also tracked down whomever owned this debt at the time and paid them off in full. Maybe I could have negotiated to pay them less, given how much they probably paid for the debt, but I settled it cleanly credit report-wise.

Since around that same time I started to really get that credit reporting agencies keep track of my tardy payments and “wow, I just paid $49 or whatever in late fees” because I couldn’t be bothered to pay attention to when my bill was due. My realization that my credit usage is also important didn’t come until the past two years. Or maybe it did, but I didn’t really feel there was much I could do about it with my job situation. Looking back I know I could have done more, including not spending more when granted magical credit line increases, but I can’t change past behavior. I can only change what I do now and look ahead.

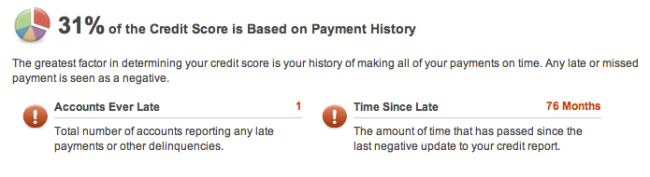

Which brings me to my point. Delinquency in credit card payments stays on your credit report for seven years. That’s a long time to be punished for your mistakes. I’m not trying to say it’s too long, or making any kind of qualitative judgment whatsoever here. But when you’re trying to improve your behavior, yeah it sucks to see that your past behavior is still dragging you down. But, alas! Hard work does pay off. There is still negative history on my report, but it’s been 76 months! Over six years! I’m so close to seeing this completely drop off:

The oldest credit report I have access to is from January 2012 (I’m pretty sure I had a subscription before that, probably in 2007 or so, but January 2012 is probably when I started my current subscription). In said 2012 report, I was using 46% of my credit. Don’t go thinking I was all that responsible–almost all of my unused available credit was a CareCredit account from when I had Lasik. Technically it’s revolving credit, but I didn’t have a physical card, and I think you can only use it for medical-type things. Either way I saw it as essentially a closed installment loan. I also had 3 accounts ever late, and was only a little over 4 years past my most recent tardiness.

Now I have less than 1% of my available credit utilized, with the balance paid off every month so I’m not paying interest. The only reason I use the cards at all is to show utilization to improve/not lower my credit score, and to earn rewards. But I don’t ever use it when I don’t have the money to pay it off sitting in my bank account. That one late account (and about 50 installment loans*) is the only red mark on my report. And it will be gone in six short months!

(Not) Free Credit Report has a “Score Planner.” I’m not positive on how accurate it is, but I guess we’ll see. With no late accounts on there it estimates my score will improve 13 points and move me into the “very low risk” category. Reducing the number of installment loans to a reasonable number will help a lot too, and my average age of accounts will only keep increasing over time.

Are you tired of reading my ramblings yet? Now is the time for the moral of the story: it takes a damn long time to remove past indiscretions from your credit report, so it’s better not to make them. But if you did make them, there’s no need to lose hope. If you keep plugging away you will start to see improvement and light at the end of the credit score tunnel.

* Actually I have eight open installment loans, down from nine a couple months ago. This is one of the reasons I’m working on paying off my smaller, lower-interest private undergraduate loans before my giant college loans. Four of the remaining nine are all in one payment/servicer, two in another, and the last two with yet another. It seems a lot like three loans instead of eight, but I’m actively working on reducing these, although I realize this will take quite some time. If I kept at my current pace, all but two of these would be paid off by mid-2016, but I can’t keep my second job forever, and that will mean paying for a place to live. There will likely be a serious reduction in the snowball sometime next year, but I’m hoping I get a significant raise, and can work to offset it.

Thanks a lot for sharing that story of yours. Nice to see that you figured out it was time to change your habits, before it was too late. Credit cards can be very dangerous but also helpful, if you know how to manage them properly. Which you seem to be doing now 🙂

Congrats on your progress!! here’s a Liebster award 😉 http://thepursuitofriches.com/2013/11/23/this-is-just-an-in-betweener-spellcheck-says-thats-not-a-real-word-but-im-a-rebel/

You should use creditkarma.com — much better way to keep track of your credit score since it’s free 🙂 Keep up the good behavior!

I actually use that too, but I haggled FreeCreditReport down to $9.99 a month, which I think is a relatively small price to pay for the boost I get from seeing the improvements they show over time.

I’ve found that CreditKarma, and even the Transunion site, are not very accurate for me. I appreciate that they think I’m only $75,000 in debt, but I know that it’s closer to $110,000.

Hhahaha well when you put it like that… no you really do have a good point though they are not the best on accuracy and there’s a pretty substantial lag… but at least it’s free 🙂