Let me tell you…I did pretty damn great through 90% of September. Then it all went to shit. But I did say I would try to get back into posting more, so here I am, the Prodigal Blogger, returning home to confess my sins.

I’ve said it before–so sorry for sounding like a broken record–but I HATE that my budget tracker doesn’t account for the fact that certain bills are paid at certain times of the month. I’ve spent about 2/3 of my October budget, and it’s currently the 8th. But I’ve also received my two planned for paychecks for the month, and I’m anxious to reduce my principal as soon into the month as possible. Pretty much the only month bills I haven’t paid yet are automatic payments that I can’t change.

Anyway, a digression, per usual. September Budget!

These are the categories where I went over budget.

Food: There are two reasons why this is over budget. Reason #1: I just noticed a Cumberland Farms purchase for $27 in here. This is likely for gas, and not for groceries, though I have been known to buy the occasional milk and eggs at Cumby’s which is how I’m guessing it got miscategorized. I’ve been seeing a bit of funky stuff with the categorization lately. Reason #2: $97 at a restaurant in NY, when we went to go visit my sister- and brother-in-law. We stayed at their house and ate their food, so I thought it would be appropriate to thank them by buying dinner. No regrets.

The Fast Food Part: This is largely buying snacks and/or chocolate milk at the cafeteria at work. I need to work on this. I have this budget for lunches at work, but it’s intended to only cover meeting a friend for lunch, and not being too lazy to pack my lunch.*

Utilities: Real talk: I have no idea how much utilities cost. I haven’t had to pay them in two and a half years, and when I did have to pay them, I didn’t have to pay for things like a water bill or the sewage commission. Whatever those things are. So those are less expected for me. I’ve since adjusted this category up to a more realistic $200. My cable and internet bill, as well as my cell phone, are not included in this category. Yes, in addition to Netflix, I also pay for cable. I blame the Bruins on this one. Bad personal finance blogger. Bad.

But anyway, in getting internet, we had to get the compatible cable modem thing (I have no idea if it’s a modem or router or what?). We could rent it for $10 a month, or pay around $100 for it. Seeing as we signed up for a two year contract, buying it outright seemed the way to go. So that gets put on our bill in three installments, the last of which is this month. So my cable bill should go down slightly next month to partially counteract the rest of my expensive utilities.

Entertainment: This is the usual Netflix $8, and I bought tickets to a show that a friend from school is performing in. I bought the tickets for the four of us, so I should actually get $75-100 of this back.

Everything Else: I feel like this should be further broken down someone, but here are the biggies:

$86 – bought flowers for the ladies I used to live with (which I’m not positive they even knew were from me as I got no acknowledgment that I sent them. Kinda really annoying).

$376 – wedding dress. This shouldn’t count, because I transferred money over, and didn’t take it out of the money I made during the month. But I still spent it. Bonus: I had some kind of PayPal balance that covered $15 of the dress. Thanks mystery shopping!

$78 – paint from Sherwin Williams and some screws from Lowe’s — to put on my new license plate.

$23 – said new license plate/DMV fees.

I also took about $100 out of the ATM this month. Most of which is actually still in my purse. Some of my coworkers took me out to lunch the day before the man and I made things legal. I brought money with me so I could at least offer to buy my own lunch–but the company did so I didn’t even need to offer/feel bad that my coworkers were buying me lunch.

Those are the biggies. There’s also $20 here or there (CVS, HomeGoods), but I’ve yet to buy anything too outlandish shopping-wise.

Looking forward (to now?) October is a weird month because I get an extra paycheck. So this will mean an extra loan payment or two, and possibly a puppy, which will mean adoption fees and probably some pretty big vet bills (particular if the lady we get is too young to be spayed already), but the extra check means I’m ready for it. It will just look like I spent stupid amounts this month. I also have to pay bar fees and get my hair did.

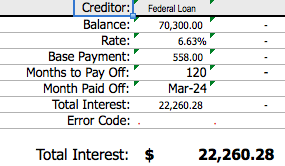

That’s all I have for this evening, but I really like re-capping, because it forces me to see the mistakes I made in the prior month, in the hopes that I won’t immediately repeat them (and, more so recently, it helps me see that I’m being unrealistic about some things). I’ll look to post a debt progress update in the next few days.

* Sometimes this actually means not having lunch food in the house. Laziness does not come into play too often anymore as the man usually makes my lunch for me in the morning. 🙂